Not known Details About Pacific Prime

Insurance also helps cover costs linked with responsibility (lawful obligation) for damage or injury triggered to a third celebration. Insurance coverage is an agreement (policy) in which an insurance firm compensates an additional against losses from details contingencies or risks.

Investopedia/ Daniel Fishel Many insurance policy kinds are offered, and basically any specific or service can locate an insurance policy firm prepared to guarantee themfor a cost. Usual personal insurance plan kinds are vehicle, health, property owners, and life insurance. A lot of individuals in the USA contend the very least one of these sorts of insurance policy, and auto insurance is called for by state regulation.

Pacific Prime Can Be Fun For Everyone

So locating the cost that is ideal for you needs some legwork. The policy limitation is the optimum amount an insurer will pay for a protected loss under a plan. Optimums may be established per period (e.g., yearly or plan term), per loss or injury, or over the life of the policy, likewise referred to as the lifetime optimum.

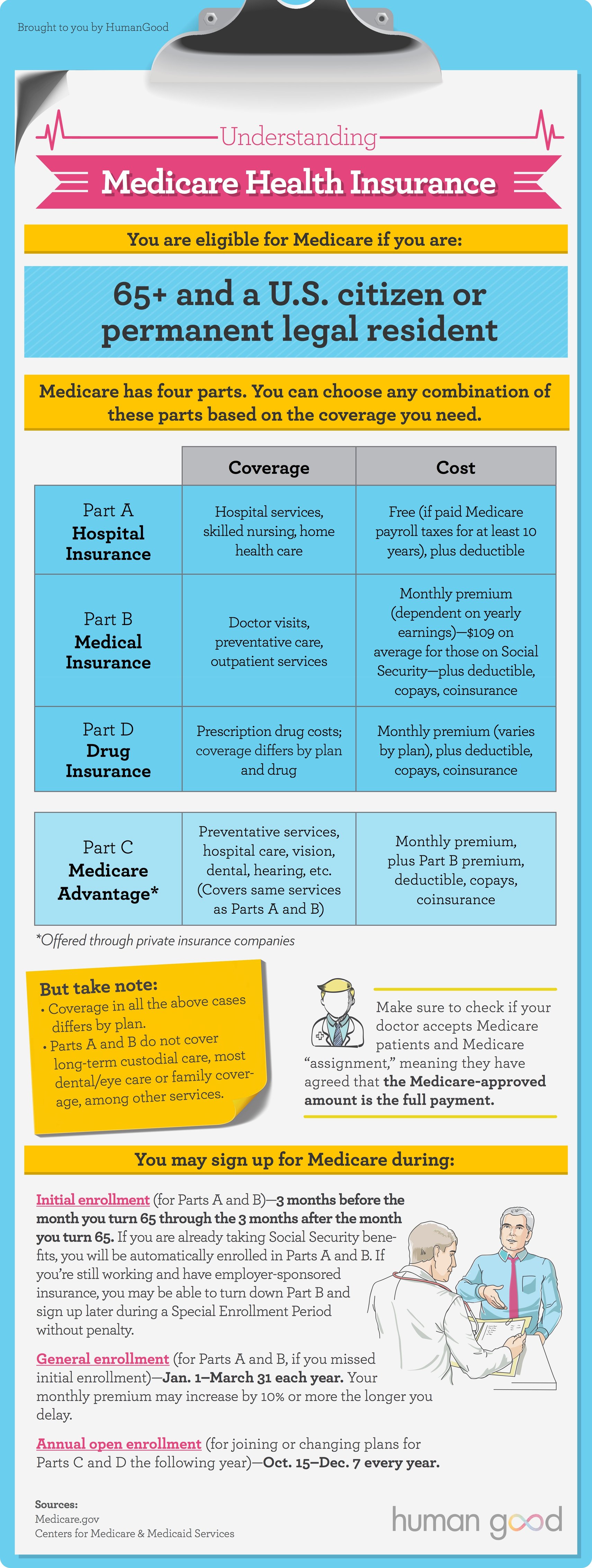

Policies with high deductibles are commonly cheaper due to the fact that the high out-of-pocket cost generally leads to fewer little insurance claims. There are several kinds of insurance. Let's take a look at the most vital. Health insurance helps covers regular and emergency healthcare costs, usually with the option to include vision and oral solutions individually.

Numerous preventative services may be covered for totally free before these are fulfilled. Health and wellness insurance may be purchased from an insurance policy firm, an insurance representative, the government Wellness Insurance policy Market, provided by a company, or government Medicare and Medicaid insurance coverage.

The Basic Principles Of Pacific Prime

Rather than paying out of pocket for automobile crashes and Related Site damage, people pay annual premiums to an auto insurer. The firm after that pays all or the majority of the covered costs linked with a car mishap or other vehicle damages. If you have actually a rented vehicle or borrowed money to get a car, your loan provider or leasing dealership will likely require you to carry car insurance policy.

A life insurance policy plan guarantees that the insurance provider pays a sum of cash to your beneficiaries (such as a spouse or kids) if you die. In exchange, you pay costs throughout your lifetime. There are two primary types of life insurance policy. Term life insurance policy covers you for a details period, such as 10 to twenty years.

Long-term life insurance coverage covers your entire life as long as you proceed paying the costs. Travel insurance covers the costs and losses connected with taking a trip, including trip terminations or hold-ups, protection for emergency situation health care, injuries and emptyings, harmed baggage, rental cars, and rental homes. Even some of the finest travel insurance coverage firms do not cover terminations or hold-ups due to weather, terrorism, or a pandemic. Insurance coverage is a way to handle your monetary threats. When you get insurance policy, you buy security against unexpected financial losses.

Pacific Prime Things To Know Before You Buy

Although there are lots of insurance policy kinds, several of the most typical are life, wellness, homeowners, and car. The best sort of insurance coverage for you will certainly depend upon your objectives and economic circumstance.

Have you ever had a moment while looking at your insurance plan or buying for insurance policy when you've believed, "What is insurance? Insurance coverage can be a strange and puzzling thing. Just how does insurance policy work?

Enduring a loss without insurance policy can put you in a tough monetary scenario. Insurance policy is a vital economic device.

Pacific Prime Things To Know Before You Buy

And in some cases, like automobile insurance policy and employees' compensation, you might be required by legislation to have insurance coverage in order to secure others - international travel insurance. Discover concerning ourInsurance choices Insurance is essentially a big wet day fund shared by numerous people (called insurance holders) and handled by an insurance provider. The insurance provider makes use of cash gathered (called costs) from its insurance holders and other investments to pay for its procedures and to fulfill its guarantee to insurance holders when they sue

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png)